These companies could be great ways to boost your passive income stream.

Many oil and gas stocks have pulled back now that the price of West Texas Intermediate crude oil (the U.S. benchmark) is hovering around $74 per barrel. Oil prices have been under pressure due to concerns over slowing global economic growth and higher OPEC+ supply.

Integrated energy major Chevron(NYSE: CVX) as well as exploration and production companies Chord Energy(NASDAQ: CHRD) and APA Corp.(NASDAQ: APA) are hovering within 7% of their 52-week lows. Here's why the sell-off in each dividend stock could be a buying opportunity.

This best-in-breed oil major also has a high yield

Daniel Foelber (Chevron): Chevron has been a remarkably stable stock to own in 2024 -- with the stock price staying fairly rangebound between $140 a share and $165 a share. But while its peer ExxonMobil is knocking on the door of an all-time high, Chevron is around just 6% off its 52-week low.

The stock looks like a fair value here. The chart shows that profits are down from peak levels a couple of years ago and are now closer to pre-pandemic levels. But so is the stock price.

However, Chevron is arguably better positioned now than before the pandemic, improving the quality of its earnings. The company has streamlined its oil and gas portfolio by focusing on areas with a low cost of production, like the Permian Basin of west Texas and eastern New Mexico. Chevron is also investing in low-carbon efforts to diversify its business and reduce its dependence on fossil fuels.

Leverage ratios like debt-to-capital and financial-debt-to-equity are also lower now than before the pandemic, as Chevron has used outsize profits to pay down debt. It exited the recent quarter with just over $4 billion in cash and cash equivalents and $23.2 billion in total debt, which is low for a company of Chevron's size. For context, Chevron spent around $6 billion on dividends and buybacks in the recent quarter, which puts into perspective how manageable its debt position is.

With a yield of 4.4% and 37 years of consecutive dividend raises, Chevron stands out as a reliable stock to boost your passive income this fall and for years to come.

One of a few Bakken field-focused companies with massive yields

Lee Samaha(Chord Energy): There's a reason why some oil companies -- namely, Chord Energy, Devon Energy, and Vitesse Energy -- have underperformed this year even as the price of oil has stayed relatively high and other peers have performed better. And it likely comes down to market sentiment over the Bakken oil field. Simply put, all three of these companies have acquired assets there.

The market didn't like Devon Energy's announced deal to buy Grayson Mills' Williston Basin (Bakken) assets. Similarly, Vitesse Energy's deal to acquire $40 million of assets in the Williston Basin also left the market unimpressed. Finally, Chord Energy's agreement to combine with Enerplus Corp. to create a "premier Williston Basin operator" hasn't set the world alight.

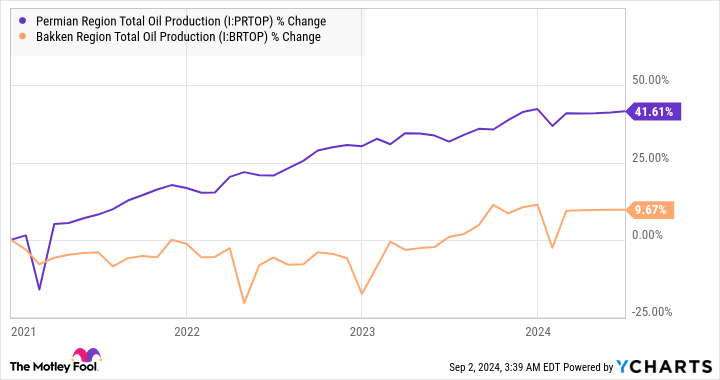

The pessimism comes from the fact that growing production in non-Permian Basin assets in the U.S. appears to be a challenge.

Still, the sell-off looks overdone. For example, Chord expects $1.2 billion in adjusted free cash flow (FCF) in 2024, representing around 13% of its market capitalization. Moreover, on the Enerplus deal announcement, management said, "The pro forma inventory supports approximately 10 years of development at the current pace."

A 13% FCF yield implies the company will generate its market cap in FCF in less than eight years. With at least a decade of development ahead, Chord Energy looks undervalued, provided the price of oil stays relatively high.

An A-OK way to grease the wheels of your passive income machine

Scott Levine (APA Corp.): You don't have to be an investor with decades of experience to recognize that sometimes the market consistently punishes stocks unfairly. That seems to be the case with APA Corp., which is now trading only 6% off its 52-week low.

While the company failed to meet analysts' earnings expectations in the first and second quarters of 2024, APA has achieved some impressive results in other regards, and it seems well-positioned to continue performing well. This all adds up to an excellent buying opportunity for patient investors who are willing to let the stock recover over time -- all the while collecting passive income from the stock's 3.5% forward-yielding dividend.

Engaging in exploration and production activities in South America, Guyana, Suriname, and the North Sea, APA strengthened its portfolio with the recent acquisition of Callon Petroleum in a transaction valued at about $4.5 billion. Thanks to the acquisition, APA increased its presence in the Permian Basin by adding 145,000 total net acres. Management expects to recognize synergies from the acquisition as well as increased free cash flow -- an encouraging sign for income investors as APA management targets returning at least 60% of free cash flow to investors in the form of dividends and share repurchases.

Valued at 2.4 times operating cash flow, shares of APA are currently trading at a discount to their five-year average cash-flow multiple of 2.8. With shares hanging on the discount rack, now's a great time to gas up on this upstream energy stock.

Should you invest $1,000 in Chevron right now?

Before you buy stock in Chevron, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chevron wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. TheStock Advisorservice has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Daniel Foelber has no position in any of the stocks mentioned. Lee Samaha has no position in any of the stocks mentioned. Scott Levine has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apa, Chevron, Chord Energy, and Vitesse Energy. The Motley Fool has a disclosure policy.

3 High-Yield Oil and Gas Dividend Stocks Hovering Around 52-Week Lows to Buy in September was originally published by The Motley Fool